Not marketing. Not talent.

Not brand or storytelling.

The number one growth level in any consumer product business is right there in the name …

🛠️ Mike Beckham with 5 asymmetric principles for new products

🤔 Mehtab Bhogal asks 11 questions to fill your product pipeline

📅 Cody Plofker reveals where to find (more) holiday margins

📈 Connor MacDonald shares how you can 3x your list growth

|

|

Connor MacDonald

Ridge, CMO

|

Why I Never Ask for a Phone Number First

When it comes to pop-ups, we don’t ask for a phone number right away. That’s the fastest way to lose people.

Instead, we start with a micro-commitment — a simple yes-or-no question that requires zero effort. One click proves intent. Once someone engages, they’re far more likely to give us their info.

That applies both to big moments, like our sweepstakes, as well as our evergreen offers …

On top of that, we want to make every pop-up hyper relevant.

We run wallets, luggage, and wedding bands as three separate categories. So if you’re shopping luggage, you’ll never see a wedding band offer.

Relevance + micro-commitments have been the biggest driver of higher conversions for us.

This approach helps Ridge build a list of subscribers who are interested in buying, not just signing up.

I broke all of this down (and much more) during Postscript’s List Size Matters webinar with Beekman 1802 and the sak.

The full replay is live right here ↓

|

|

Mike Beckham

CEO, Simple Modern

|

The Asymmetric Product Development Playbook: 5 Principles That Work

The best product doesn’t win.

That’s cliché. And it’s true. Especially for founders who’ve achieved significant success with a core offering.

What does win? This …

The brand with (1) the greatest assortment of products that (2) are the best at one thing each, (3) can improve them 5–10% with every release, and still manage to (4) launch more new products aimed at (5) markets that are big enough to have asymmetric outcomes.

Over the years, I’ve learned this the hard way.

If I could do it all over again, I would have invested more in product development.

That’s why, today, I want to help you understand what actually works with five principles.

- High Variance, Big Swings

- CAC Versus LTV Products

- Quantify Your Market

- Every CEO’s Central Tension

- Be the Best in Just One Way

The High-Variance Nature of Building Products

First, building new products is an asymmetric game.

By definition, you will have several stories of trying something that was stupid, pouring in resources, and then having to abandon it. Or you’ll have a good idea, decide not to pursue it, and watch somebody else make it a massive success.

The metaphor Sean uses is lottery tickets.

Whether you’ll win or lose isn’t the question. Losing is guaranteed. It’s whether you’re buying enough tickets so that one or two winners offset the rest.

If you are doing asymmetric things, your goal is to get a high quantity of shots on goal. The chances of any one swing working are low, but the odds of a home run increase with each swing.

Back in 2018, after Amazon’s Fire phone failed, Jeff Bezos wrote: “We lost a lot of money on this one and we are going to have even bigger failures than that in the future. If we are going to continue to scale we have to continue to make bold bets.”

To be honest, the most remarkable part about my career isn’t what gets highlighted. It is not that we’ve done over two billion dollars in retail sales.

It’s how many times I’ve almost made a crazy amount of money — hundreds of millions in additional dollars — and then screwed it up somehow.

Am I an idiot? Maybe. But I don’t think so.

That’s the cost of admission to asymmetrical, high-variance activities.

You’ll be wrong frequently. You’ll be close and not execute. That’s okay as long as what you’re pursuing has a disproportionate upside.

Understand “CAC Versus LTV” Products

Second, not all new products serve the same purpose. There’s really only two types: CAC products and LTV products.

LTV products make your business 10% better. They’re attach-rate plays, something you can sell to the customers you already have. CAC products are multipliers — 2x, 5x, even 10X’ers. They’re hero products that acquire new customers and fundamentally expand your addressable market.

Different initiatives have different purposes.

Most mistakes come from not understanding that distinction when you’re choosing what to create next.

At Simple Modern, our seasonal collections, licensing deals, and “Signature” lines (premium versions) are LTV products.

They optimize our existing flywheel.

A new or better version designed to expand the value of people who already buy from us.

On the CAC front, we tried launching backpacks for adults and essentially failed. Then we launched children’s backpacks for our current customers’ kids.

Those connected.

Outsized impact because it expanded our market.

Trevi, our electrolyte-powder brand, is the ultimate example.

Like Apple launching the iPhone, it’s almost unbounded how much a net-new product can change your trajectory.

Evaluate Your Investment by Quantifying the Market

Third, perhaps the most important thing we’ve done is form an investment committee.

Our product pipeline brings ideas to us before they start working on anything, and we pass everything through this committee.

We talk about the fundamentals.

- What’s the total addressable market?

- What are our chances of success?

- How big do we have to win … to win?

- Are we uniquely positioned somehow?

- Does this really fit with the brand?

From there, we go or no-go.

It’s a great exercise to make people back-of-the-envelope justify something with numbers. You take an idea out of the abstract and say, “Make a quantitative case. What do I have to believe for this to really be meaningful?”

Sometimes you’ll find that the existing market is so small, you have to win it all. At other times, you realize the market’s so massive that you can achieve a truly meaningful outcome if you’re the number nine player in the space.

One of my favorite quotes on this comes from Andy Rachleff, the co-founder of Benchmark Capital:

“When a great team meets a lousy market, market wins. When a lousy team meets a great market, market wins. When a great team meets a great market, something special happens.”

In all cases, market is the most important.

Navigate the Central Tension as CEO

Fourth, prepare yourself to live between two tensions.

On one extreme, your team comes to you with something beautiful they’ve developed, and you say, “We’re not going to launch it.” That’s really demotivating to people who’ve invested months of their lives bringing a new product to life.

However, the opposite extreme is worse.

They show you something compelling, and you say, “That is amazing. Let’s get that to people right now.” They respond with, “It’s not ready yet. It’s still baking.”

You come back a month later, and they say, “Still baking. Not done yet.” A quarter later, same response. A year goes by, and you’ve missed your moment entirely.

Being a CEO is challenging when it comes to these decisions.

Nobody else in the organization has the power to tell someone who’s emotionally invested several months into developing a new product that you’re killing it.

No upside exists. Money’s been invested, time’s been invested, somebody’s emotionally invested. But that’s the job.

I haven’t done this perfectly. I wish I’d killed some projects earlier in the pipeline than I did. Conversely, when something works in development, the only thing that matters after that — the only way you win anything — is getting it out into the world.

Iterate Until Every Product Is the Best in One Way

Fifth, with all this emphasis on new, don’t make the mistake of treating the launch like the finish line.

With Trevi, our first batch of flavors consistently beat competitors in blind taste tests, but not by much. Our second batch showed solid improvement.

When we released our third batch, retention jumped 2.5X. The business unit went from really good to potentially life-changing.

It only happened because we have our sights set on being the best-tasting electrolyte powder on the market.

And it has to keep happening.

Customers can’t remember or explain a product that’s decent at ten different things. But they’ll remember and recommend something that’s the absolute best at one.

It’s the same at Simple Modern.

When we developed our new straw lid, I spent weeks testing thousands of prototypes. Everyone in our company did. That commitment to perfecting one element is what creates products people can’t help but talk about.

Your product’s remarkable quality in one specific area (being the best) becomes your marketing message, your competitive advantage, and your customer acquisition engine all combined.

Even better, knowing that the start isn’t the end helps you not to wait too long to launch. Continuous improvement lets you move quickly to get customer feedback and iterate.

Bias to action over baking to “perfection.”

The Bottom Line on Building Products

Product development isn’t innovation theater, nor is it chasing shiny objects.

It’s systematically choosing what new products to develop, understanding the purpose of each, and having the discipline to invest when it’s working or kill projects when they’re not.

Above all, it’s about recognizing that new products are an asymmetric game where failure is part of the process.

Your job isn’t to avoid failure.

It’s to structure your product development so that when you do launch something successful, it’s successful enough to make all the misses worth it.

That’s the game. That’s how you win.

|

|

Cody Plofker

CEO, Jones Road Beauty

|

The Holiday Margin Lever Most Brands Miss

Black Friday’s coming. If you’re hunting for margin levers that don’t mess with conversion, read this …

Last year at Jones Road, we activated Rokt Thanks on our thank you page. No dev work, no disruption, just personalized post-checkout offers from trusted brands.

And it worked.

- +$0.40 in profit per order

- Zero impact on retention

- All post-purchase placements

During peak season, it became a sleeper hit.

The offers feel native, the UX stays clean, and the revenue stacks, order after order.

You can forecast your upside now, just punch your numbers into the calculator and see what’s on the table.

If you want to turn your thank you page into a true profit engine on Black Friday, Cyber Monday … this is your move.

|

|

Mehtab Bhogal

Founder, Karta Venture

|

11 Questions to Answer Before Launching New Products

Product is the best way to increase revenue, lower CAC, and grow profits. Unfortunately, most brands wait until performance slows to launch something new.

By then, it’s too late. You’re already in a bad position.

What you need is a product pipeline.

And a rubric to vet your ideas.

When developing new products, here are the questions I like to think through with my brands …

1. What channels will this product live in?

Products that can be visually demonstrated with a clear before-and-after, have a huge TAM, and can comfortably afford a ~$60 CAC tend to work really well on websites.

If I’m trying to break into convenience stores, that price point won’t work. When selling into retail, I need to make sure my margin structure, packaging, and overall offering fit into the exact type of retailer I am trying to sell to. What a big box retailer wants is going to be very different than an off-price retailer.

Think through how the product will play with your existing primary channels.

Is it something retailers carrying your main assortment can incorporate? Do your displays work for it, or will you need new displays? What’s the cost of these displays, and how does that impact the number of doors you can launch into? Is it something you can only realistically sell on your own site?

2. Will it help fix my business’s weaknesses?

For example, we once owned a women’s apparel brand that had winter styles as a core product.

Eventually, we pushed into swimwear by creating swimsuits that flattered moms and were conservative. This appealed to our audience, which was primarily new moms.

It fixed our seasonal cash flow issues and grew LTV substantially.

3. What’s the total addressable market?

Please think this through all the way.

When you do … you’ll find your total addressable market shrinks very, very fast.

My favorite example is simply showing brands that their main product they thought had a $1B TAM is sold ~80% via retail channels, and their current price point doesn’t allow them to win shelf space there.

Their TAM isn’t really $1B, it’s $200M. Can you expand that TAM? Of course. It’s an uphill battle, though.

4. How defensible is this SKU against knockoffs?

Do we have IP we can build around the product, or an engineering moat?

I love these two moats because they have a fixed cost, which means they have excellent operating leverage.

If your only moat is being first to market, expect competitors to erode margins quickly.

5. Will it raise or lower my average gross margins?

Better margins make your business easier to run and generally more idiot proof. That doesn’t mean you should always gravitate towards higher margins, but if you have the choice … take it.

6. Who is this product primarily for?

My core customer? A completely new customer?

Is it something I can expect performance as soon as the product is released, or will it require more investment because our existing adstock is worthless?

7. Does it improve seasonality balance?

Adding a winter-heavy product when I’m summer-skewed reduces volatility. Evaluate inventory and ordering dynamics as they relate to both retail and DTC channels.

8. How much cash will it require?

What are the minimum order quantities? How fast can I test it? Can I validate with 500 units and a landing page in 30 days, or is this going to require serious cash and a real launch?

And be sure to look closely at what the new product’s working capital dynamics are versus your current products.

9. Does it unlock new geographies?

Sometimes your existing products are difficult to sell into other countries because of regulatory reasons or shipping dynamics.

10. What’s the downside if it fails?

What is our plan for dead inventory? Your risk needs to be acceptable. If you’re launching something meant for a specific type of retailer that needs specific packaging … liquidating that inventory is going to be very tough.

11. Does it create operational complexity disproportionate to profit?

Will this SKU give me additional leverage with existing suppliers, or is it something I need to build a new supply chain for?

This should give you plenty of firepower to think through a new product before you pursue it.

Can you ride one SKU to success?

Yes! If you’re lucky. However, most of us are not lucky and born with a face for radio.

Kitsch is my favorite example.

They didn’t stop at hair ties and scrunchies. They expanded into shower caps, pillowcases, satin heatless curlers, and more. They have the perfect product assortment for every channel, whether it’s their site, Amazon, big box retail, and smaller retailers.

Even if your product has an amazing IP or engineering moat, competitors will ruthlessly copy the benefits of your product.

It’s a core feature of capitalism. As soon as you do well, the market will attempt to crush your margins.

Don’t wait until your core SKUs are struggling.

It takes time to fill the pipeline for most consumer businesses because we are dealing with physical products.

That’s why it’s critical to keep your product pipeline full.

Masterclass in Product Development (What Actually Works)

How We’re Reaching New Audiences on Meta with Partnership Ads

Curated by the editor of CPG Wire, this week’s five biggest consumer-news headlines.

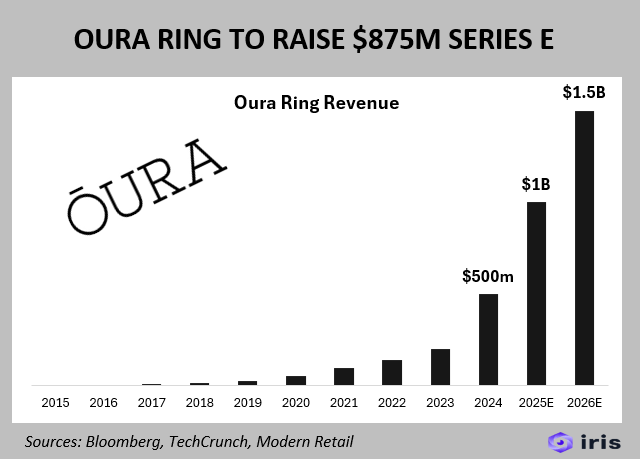

1. Oura Ring His ~$11B Valuation With Series E: Reuters

Oura Health, the Finnish maker of the popular Oura smart ring, secured $875M in Series E funding, valuing the company at approximately $10.9B. The round doubles Oura’s valuation from its $5B Series D round last November.

To date, the company has sold over 5.5M rings, with +2.5M sold in the past year alone. Oura generated over $500M in revenue in 2024 and aims to hit $1B during 2025. The company also secured a $250M revolving credit facility from major banks, including JPMorgan Chase and Goldman Sachs.

2. Slate Milk Secures Series B Funding: LinkedIn

Slate Milk, a purveyor of high-protein milk shakes and iced coffees, secured $23M in Series B funding. The round was led by Foundership Ventures, a new venture firm founded by Drew Harrington and Amanda Klane, the co-founders of Yasso (acquired by Unilever in 2023).

Manny Lubin and Josh Belinsky launched Slate Milk in 2018, and its retail footprint is approaching 100k points of distribution.

3. Glanbia Divests SlimFast: PR Newswire

Global nutrition company Glanbia is selling SlimFast to Heartland Food Products Group, the owner of Splenda and a scaled manufacturer of low-calorie sweeteners, coffee creamers, and water enhancers.

Glanbia acquired SlimFast in 2018 for $350 million but deemed it a “non-core” asset earlier this year. The divestment enables Glanbia to focus on its higher growth brands like Optimum Nutrition and ISOPURE.

4. Khloud Appoints New CEO: Food Business News

Khloud, the fast-growing protein snack brand founded by Khloé Kardashian, appointed CPG vet Jason Rubenstein as CEO.

In addition to stints at Health-Ade and Vita Coco, Rubenstein most recently served as the President and Chief Growth Officer of Poppi, the modern soda brand that PepsiCo acquired for $1.9 billion earlier this year. Khloud also announced upcoming launches at Walmart, Kroger, and Albertsons.

5. Alice Mushrooms Raises $8M: Instagram

Functional mushroom chocolate brand Alice scored $8 million in Series A funding. The round was led by NewBound Venture Capital — an investor in K18, Hoplark, and Gratsi — with additional backing from Unilever Ventures and Tiesto.

Alice Mushrooms will use the funding to support its nationwide rollout at 1,300 new doors.

TEASER ALERT

Later this week, we’re launching a brand new thing!

It is the biggest, highest-production, most-multi-media project we’ve ever undertaken …

- Fresh show + format

- An upcoming event

- Plus full written guide

If you’re not already following our podcasts or the Operators LinkedIn account, please jump on board.

You don’t want to miss it.

With thanks and anticipation,

Aaron Orendorff 🤓

Chief Content Officer

Disclaimer: Special thanks to Postscript + Rokt for sponsoring today’s newsletter.